Understanding The Lincoln, Maine Tax Map: A Comprehensive Guide

Understanding the Lincoln, Maine Tax Map: A Comprehensive Guide

Related Articles: Understanding the Lincoln, Maine Tax Map: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding the Lincoln, Maine Tax Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Lincoln, Maine Tax Map: A Comprehensive Guide

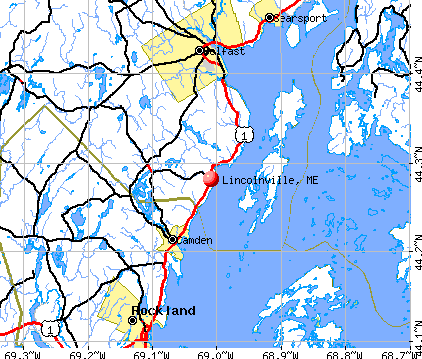

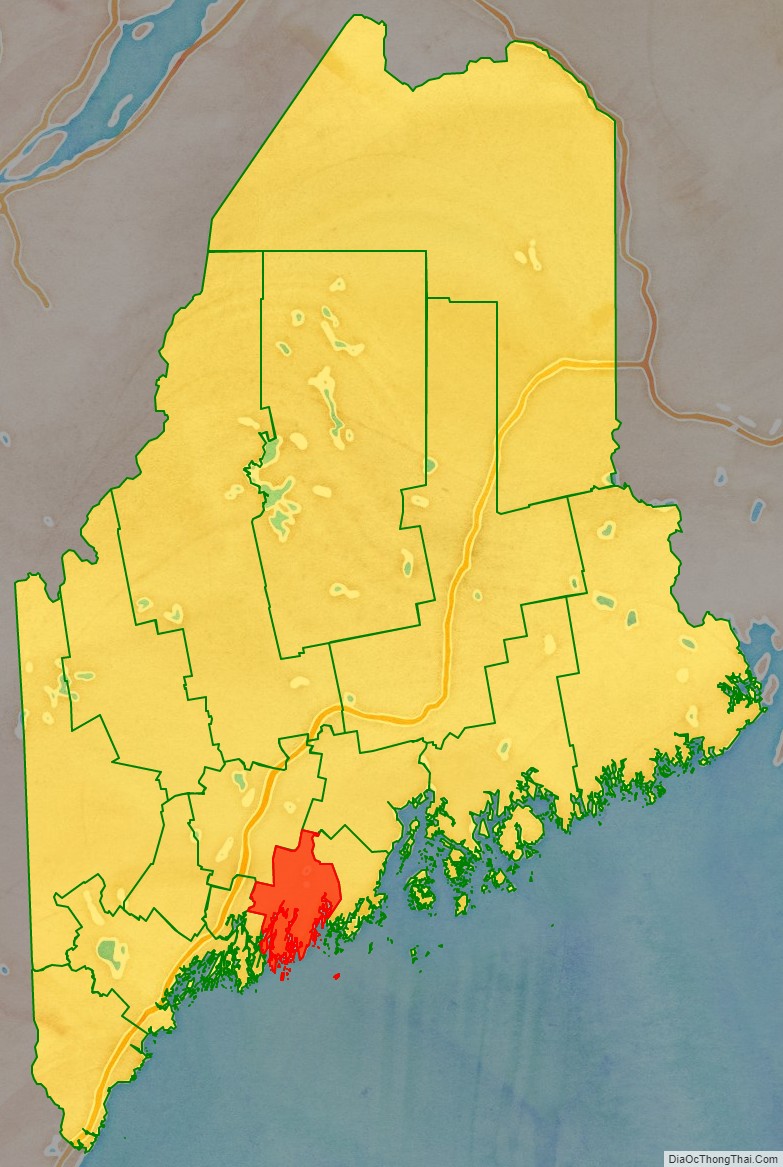

The Lincoln, Maine Tax Map serves as a vital tool for navigating the town’s property landscape. It provides a comprehensive overview of land ownership, boundaries, and property values, offering a crucial resource for residents, property owners, and those interested in the town’s real estate market.

Decoding the Lincoln, Maine Tax Map

The Lincoln, Maine Tax Map is a visual representation of the town’s properties, divided into individual parcels. Each parcel is assigned a unique identification number, referred to as the "lot number." This number serves as a primary key for accessing information about the property, such as its owner, address, size, and assessed value.

The map itself is typically presented as a series of layers, each representing a specific aspect of the property data. These layers may include:

- Property Boundaries: These lines delineate the physical limits of each property, providing a clear visual of land ownership and potential easements.

- Lot Numbers: Each parcel is assigned a unique lot number, enabling efficient referencing and data retrieval.

- Property Addresses: The map displays the official addresses of each property, facilitating location identification and navigation.

- Assessed Values: The map may indicate the assessed value of each property, a crucial factor in determining property taxes.

- Zoning Districts: The map may highlight different zoning districts within the town, providing insights into permitted land uses and development regulations.

Accessing the Lincoln, Maine Tax Map

The Lincoln, Maine Tax Map is typically accessible through the following channels:

- Town Hall: The Town of Lincoln’s office usually maintains a physical copy of the tax map, available for public inspection during business hours.

- Town Website: Many municipalities provide digital versions of their tax maps on their official websites. These online maps may be interactive, allowing users to zoom, pan, and search for specific properties.

- County Assessor’s Office: The Penobscot County Assessor’s Office may also offer access to the Lincoln, Maine Tax Map, potentially through their online platforms or upon request.

Importance and Benefits of the Lincoln, Maine Tax Map

The Lincoln, Maine Tax Map holds significant value for various stakeholders:

Property Owners:

- Property Identification: The map clearly identifies the boundaries of their property, helping to resolve any potential disputes or boundary issues.

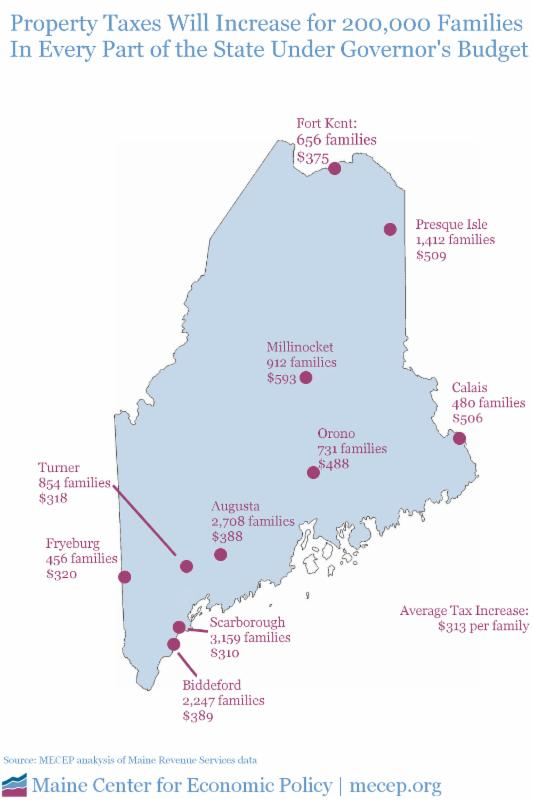

- Tax Information: The map displays the assessed value of the property, providing crucial information for calculating property taxes and understanding their tax obligations.

- Property Sales and Transfers: The map is a vital tool for real estate transactions, providing a clear visual representation of the property and its associated data.

Potential Buyers:

- Property Exploration: The map allows potential buyers to visualize property boundaries, size, and location within the town, aiding in their decision-making process.

- Property Value Assessment: The map can provide insights into the assessed value of properties in the area, helping buyers gauge market trends and potential investment opportunities.

Town Officials and Planners:

- Land Use Management: The map provides valuable data for land use planning, zoning regulations, and infrastructure development.

- Property Tax Assessment: The map facilitates the accurate assessment of property values, ensuring equitable distribution of tax burdens.

- Public Service Delivery: The map helps town officials understand property locations and boundaries, aiding in the efficient delivery of public services such as road maintenance and snow removal.

Frequently Asked Questions (FAQs)

Q: How can I find the property tax rate for my property in Lincoln, Maine?

A: The property tax rate is determined by the Town of Lincoln. You can access this information through the Town’s website or by contacting the Town Assessor’s Office directly. The tax rate may vary depending on the property’s assessed value and the town’s budget requirements.

Q: What if I notice an error or discrepancy on the Lincoln, Maine Tax Map?

A: Contact the Town Assessor’s Office immediately to report any inconsistencies or errors. They will investigate the issue and make necessary corrections to ensure the map’s accuracy.

Q: Can I obtain a copy of the Lincoln, Maine Tax Map for personal use?

A: The availability of copies may vary. Contact the Town Hall or the Assessor’s Office to inquire about obtaining a physical or digital copy of the map.

Tips for Utilizing the Lincoln, Maine Tax Map

- Familiarize Yourself with the Map’s Legend: Understand the symbols, colors, and abbreviations used on the map to interpret the information accurately.

- Use the Map’s Search Function: If the map is interactive, utilize its search function to locate specific properties by address, lot number, or other criteria.

- Cross-Reference with Other Data Sources: Combine the tax map information with other resources, such as property records, zoning ordinances, and real estate listings, for a more comprehensive understanding.

- Consult with Professionals: For complex property inquiries or legal matters, consult with a real estate attorney, surveyor, or licensed appraiser.

Conclusion

The Lincoln, Maine Tax Map serves as a vital tool for understanding the town’s property landscape. Its comprehensive overview of land ownership, boundaries, and property values empowers residents, property owners, and officials to make informed decisions regarding real estate transactions, property taxes, and land use planning. By utilizing this resource effectively, stakeholders can navigate the complexities of property ownership and contribute to the continued growth and development of the town.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Lincoln, Maine Tax Map: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!