Navigating The Path To Homeownership In North Carolina: Understanding USDA Rural Development Loans

Navigating the Path to Homeownership in North Carolina: Understanding USDA Rural Development Loans

Related Articles: Navigating the Path to Homeownership in North Carolina: Understanding USDA Rural Development Loans

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Path to Homeownership in North Carolina: Understanding USDA Rural Development Loans. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership in North Carolina: Understanding USDA Rural Development Loans

The dream of homeownership is a powerful one, but for many in North Carolina, the financial hurdles can seem insurmountable. Enter the USDA Rural Development Loan program, a government-backed financing option specifically designed to make homeownership accessible in rural areas. This article delves into the intricacies of USDA loans in North Carolina, providing a comprehensive guide for prospective homeowners.

Understanding the Scope of USDA Loans in North Carolina:

The USDA Rural Development Loan program, often referred to as the "USDA Loan," is a unique financing option for individuals seeking to purchase, build, or rehabilitate a home in eligible rural areas. North Carolina boasts a vast network of eligible areas, encompassing both established rural communities and burgeoning suburban neighborhoods.

Key Features of USDA Loans:

- Low Down Payment: USDA loans typically require a down payment of just 0%, making them an attractive option for borrowers with limited savings.

- Flexible Credit Requirements: While credit score requirements exist, USDA loans are known for their flexibility compared to conventional mortgages, opening doors for borrowers with less-than-perfect credit histories.

- Competitive Interest Rates: USDA loans offer competitive interest rates, often lower than those offered by conventional lenders.

- No Private Mortgage Insurance (PMI): Unlike many conventional loans, USDA loans do not require PMI, saving borrowers substantial monthly costs.

- Affordable Housing: USDA loans prioritize affordability, with income limits varying depending on the location and household size.

Eligibility Criteria for USDA Loans in North Carolina:

To qualify for a USDA loan in North Carolina, borrowers must meet specific criteria:

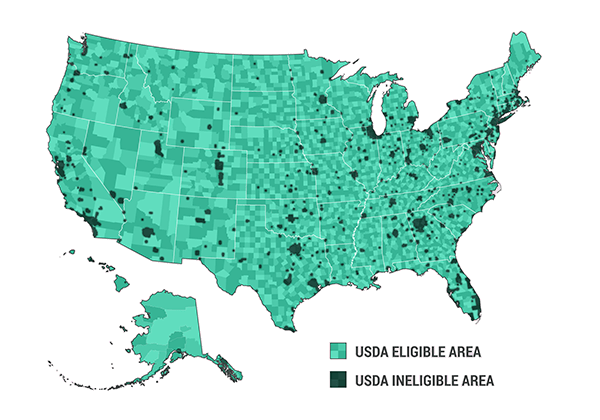

- Property Location: The property must be located in an eligible rural area, as defined by the USDA. The USDA Rural Development website provides an interactive map tool to determine eligibility.

- Income Limits: Borrowers’ income must fall within specific limits set by the USDA, which vary depending on the household size and location.

- Credit History: While credit score requirements are not as strict as those for conventional loans, borrowers must demonstrate a responsible credit history.

- Occupancy Requirement: The property must be the borrower’s primary residence.

- Property Type: The property must be a single-family home, townhouse, condominium, or manufactured home.

The Benefits of Choosing a USDA Loan:

- Reduced Financial Burden: The low down payment and competitive interest rates significantly reduce the initial investment and monthly mortgage payments, making homeownership more attainable.

- Access to Rural Areas: USDA loans open doors to a wider range of housing options in rural areas, often overlooked by traditional lenders.

- Community Development: By fostering homeownership in rural areas, USDA loans contribute to economic growth and revitalization of rural communities.

- Environmental Sustainability: The USDA promotes energy-efficient housing practices, encouraging sustainable home construction and renovation.

Navigating the Application Process:

The application process for a USDA loan in North Carolina typically involves the following steps:

- Pre-Approval: Obtain pre-approval from a USDA-approved lender, demonstrating financial readiness and eligibility.

- Property Search: Locate a suitable property within an eligible rural area.

- Property Appraisal: Have the property appraised by a USDA-approved appraiser to determine its market value.

- Loan Application: Submit a complete loan application with all required documentation to the lender.

- Loan Approval: The lender reviews the application and, if approved, issues a loan commitment.

- Closing: Complete the closing process, signing all necessary documents and receiving the loan funds.

FAQs about USDA Loans in North Carolina:

Q: What are the income limits for USDA loans in North Carolina?

A: Income limits vary depending on the household size and location. You can find specific income limits for your area on the USDA Rural Development website.

Q: Can I use a USDA loan to purchase a property in a town or city?

A: While USDA loans are primarily designed for rural areas, some towns and cities may be considered eligible. It’s essential to check the USDA Rural Development website to determine eligibility.

Q: What are the credit score requirements for a USDA loan?

A: Credit score requirements are generally less stringent than those for conventional loans. However, a good credit history is still essential for approval.

Q: What are the costs associated with a USDA loan?

A: USDA loans typically involve closing costs, similar to those for conventional mortgages, but they do not require private mortgage insurance.

Q: How do I find a USDA-approved lender in North Carolina?

A: The USDA Rural Development website provides a list of approved lenders in North Carolina.

Tips for Securing a USDA Loan in North Carolina:

- Research Eligible Areas: Utilize the USDA Rural Development website’s interactive map tool to identify eligible areas that align with your housing preferences.

- Consult with a USDA-Approved Lender: Engage with a reputable lender specializing in USDA loans to obtain pre-approval and guidance throughout the process.

- Maintain Good Credit: Ensure a strong credit history by paying bills on time and managing debt responsibly.

- Gather Required Documentation: Prepare all necessary documents, including income verification, credit reports, and property information, to expedite the application process.

- Explore Housing Options: Research available properties in eligible areas, considering factors such as size, condition, and amenities.

Conclusion:

The USDA Rural Development Loan program presents a unique opportunity for North Carolina residents seeking to achieve the dream of homeownership. By leveraging the program’s benefits, individuals can access affordable financing options, explore a wider range of housing options, and contribute to the growth and vitality of rural communities. Navigating the program requires careful planning, thorough research, and collaboration with a knowledgeable lender. With careful preparation and commitment, homeownership in North Carolina can become a reality for many through the USDA loan program.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership in North Carolina: Understanding USDA Rural Development Loans. We thank you for taking the time to read this article. See you in our next article!