Navigating The Path To Homeownership In North Carolina: Understanding The USDA Loan Map

Navigating the Path to Homeownership in North Carolina: Understanding the USDA Loan Map

Related Articles: Navigating the Path to Homeownership in North Carolina: Understanding the USDA Loan Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Path to Homeownership in North Carolina: Understanding the USDA Loan Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Path to Homeownership in North Carolina: Understanding the USDA Loan Map

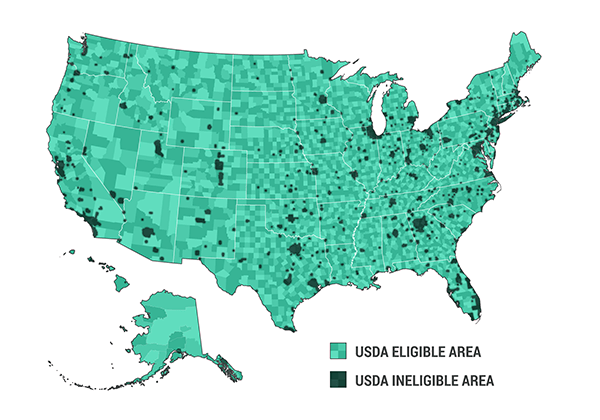

The dream of homeownership is a powerful motivator for many, but the financial realities can often feel daunting. In North Carolina, the United States Department of Agriculture (USDA) Rural Development program offers a lifeline to those seeking to purchase a home in eligible areas. This program, accessible through the USDA Loan Map, can make the dream of homeownership a reality for many North Carolinians.

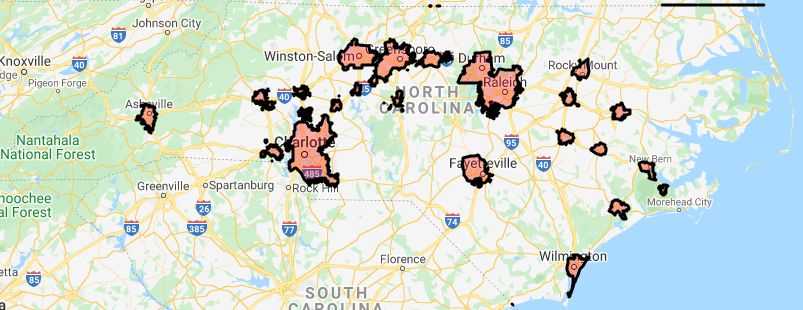

The USDA Loan Map: A Guide to Eligibility

The USDA Loan Map serves as a crucial tool for potential homebuyers in North Carolina. It visually depicts areas eligible for USDA financing, providing a clear understanding of which counties and specific locations qualify for the program. This map is instrumental in determining whether a prospective homebuyer can utilize the USDA loan program to secure their mortgage.

Understanding the Eligibility Criteria

To qualify for a USDA loan, a property must fall within an eligible area designated by the USDA. The USDA Loan Map is the primary resource for determining eligibility. The map is updated regularly, so it’s essential to consult the most recent version to ensure accuracy.

Beyond geographical location, borrowers must meet other eligibility criteria, such as:

- Income Limits: The USDA program sets income limits based on household size for each eligible area. These limits ensure that the program benefits those who need financial assistance to purchase a home.

- Credit Score: A strong credit score is essential for obtaining a USDA loan. While the minimum credit score requirement varies, generally, a score above 640 is considered favorable.

- Debt-to-Income Ratio: The USDA assesses the borrower’s debt-to-income ratio (DTI), comparing their monthly debt obligations to their gross monthly income. A lower DTI generally improves loan approval chances.

- Property Type: The USDA program primarily targets single-family homes for owner-occupancy. While multi-family properties are sometimes eligible, they must meet specific requirements.

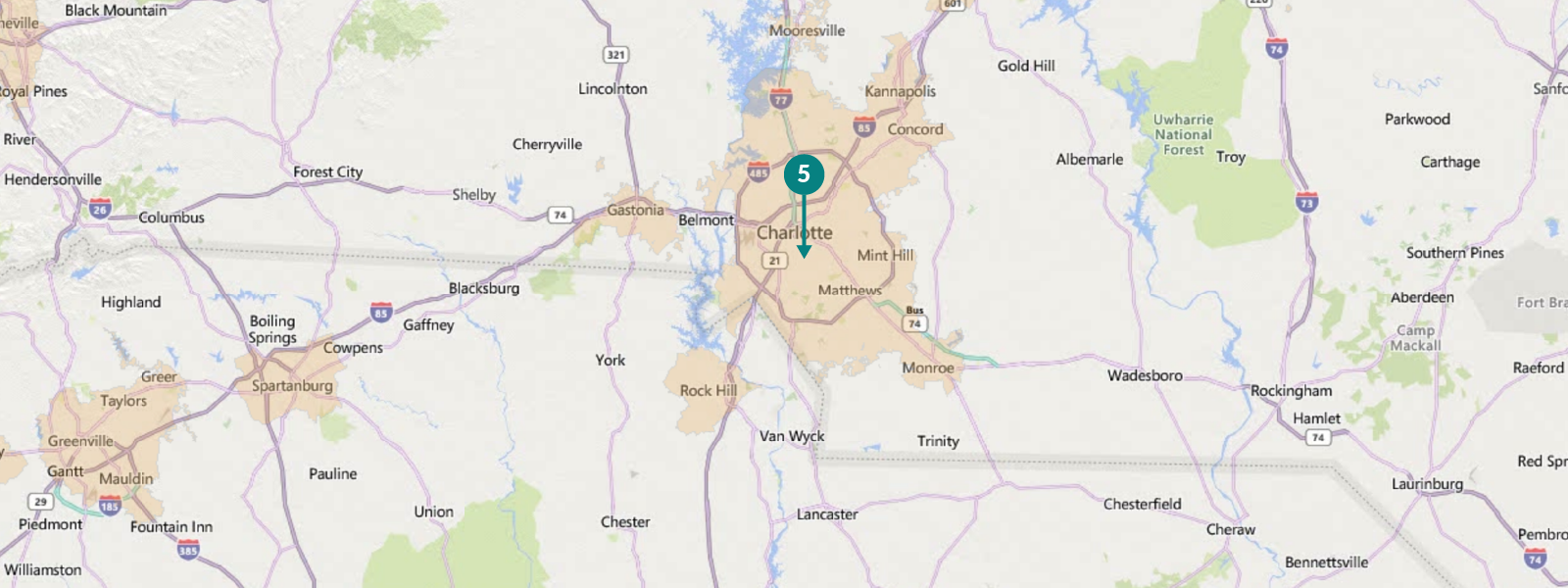

- Location: The USDA loan program is designed to promote homeownership in rural areas. While some suburban areas may be eligible, they must meet specific criteria based on population density and other factors.

Benefits of a USDA Loan

The USDA loan program offers several advantages for eligible homebuyers in North Carolina:

- Low Down Payment: One of the most attractive features of USDA loans is the requirement of only a 0% down payment. This significantly reduces the financial barrier to entry for homeownership.

- No Mortgage Insurance: Unlike conventional loans, USDA loans do not require private mortgage insurance (PMI), which can save borrowers hundreds of dollars per month.

- Competitive Interest Rates: USDA loans typically offer competitive interest rates, making them an attractive option for borrowers seeking to minimize their overall borrowing costs.

- Flexible Credit Guidelines: The USDA program has flexible credit guidelines compared to conventional loans, potentially benefiting borrowers with less-than-perfect credit histories.

- Affordable Housing Solutions: The USDA program prioritizes providing affordable housing options to eligible borrowers, helping them achieve homeownership in areas where market prices might be otherwise unattainable.

The USDA Loan Map: A Tool for Empowering Homebuyers

The USDA Loan Map serves as a crucial tool for empowering potential homebuyers in North Carolina. It provides transparency and accessibility, allowing individuals to quickly determine their eligibility for the USDA loan program. This map helps individuals make informed decisions about their homeownership journey, enabling them to pursue their dreams with confidence.

Navigating the USDA Loan Process in North Carolina

Once a prospective homebuyer identifies an eligible property using the USDA Loan Map, they can begin the loan application process. This typically involves:

- Pre-Approval: Obtaining pre-approval from a USDA-approved lender is a crucial step. Pre-approval demonstrates financial readiness and can strengthen the buyer’s negotiating position.

- Property Search: With pre-approval in hand, the buyer can actively search for eligible properties within the designated areas identified on the USDA Loan Map.

- Loan Application: Once a suitable property is found, the buyer submits a loan application to the chosen lender, including supporting documentation such as income verification, credit history, and property details.

- Loan Processing: The lender thoroughly reviews the application and supporting documents to assess the borrower’s eligibility and the property’s suitability.

- Loan Closing: Upon successful loan approval, the buyer proceeds with the closing process, signing the loan documents and finalizing the property purchase.

Frequently Asked Questions about the USDA Loan Map in North Carolina

1. What is the USDA Loan Map?

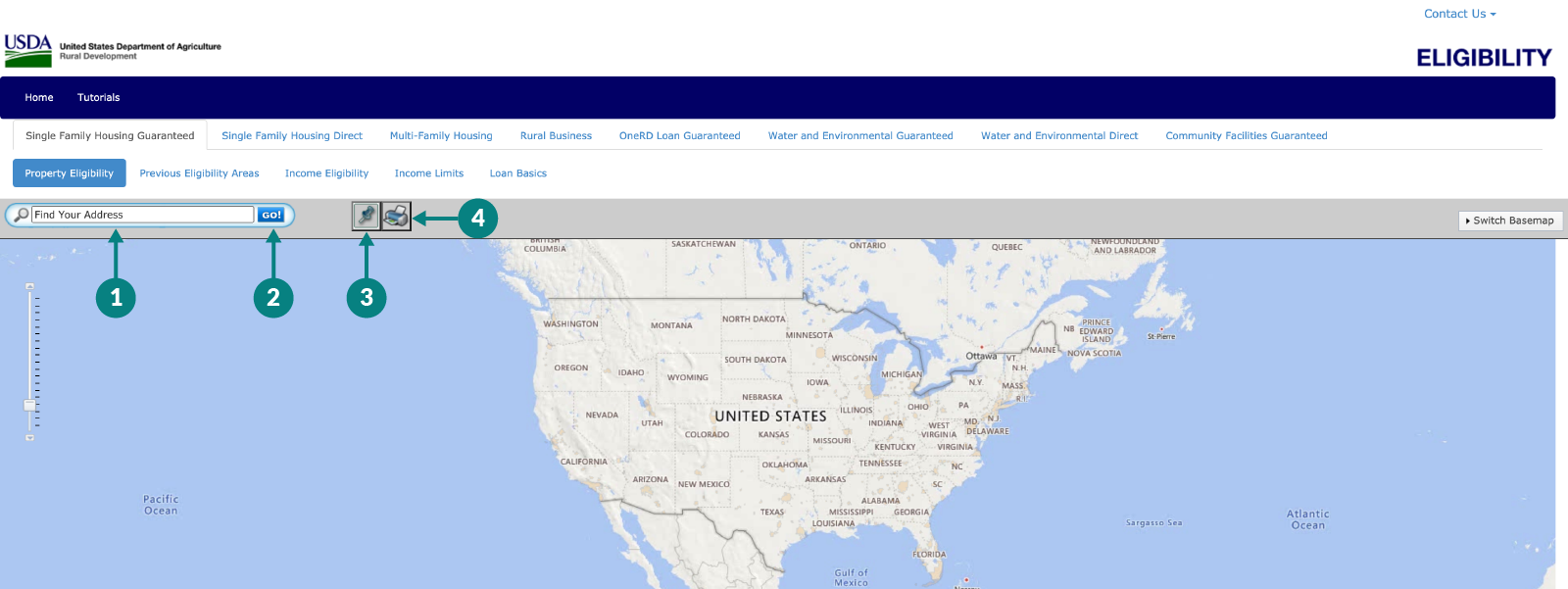

The USDA Loan Map is an interactive tool that identifies areas in North Carolina eligible for USDA financing. It visually depicts counties and specific locations where the USDA loan program is available.

2. How can I access the USDA Loan Map?

The USDA Loan Map is readily accessible online through the USDA Rural Development website. You can find it by searching for "USDA Loan Map" or visiting the official USDA website.

3. What are the income limits for USDA loans in North Carolina?

Income limits for USDA loans in North Carolina vary depending on the county and household size. You can find the specific income limits for your area on the USDA Loan Map or by contacting a USDA-approved lender.

4. Do I need a down payment for a USDA loan?

No, USDA loans typically require a 0% down payment. This makes homeownership more attainable for eligible borrowers.

5. Is there a minimum credit score requirement for a USDA loan?

While the minimum credit score requirement can vary, generally, a score above 640 is considered favorable for USDA loan approval.

6. What types of properties are eligible for USDA loans?

USDA loans primarily target single-family homes for owner-occupancy. While multi-family properties are sometimes eligible, they must meet specific requirements.

7. How do I find a USDA-approved lender in North Carolina?

The USDA website provides a directory of USDA-approved lenders. You can also contact your local real estate agent or mortgage broker for recommendations.

8. What are the benefits of using a USDA loan?

Benefits of USDA loans include a 0% down payment, no mortgage insurance, competitive interest rates, flexible credit guidelines, and affordable housing solutions.

9. How can I learn more about the USDA loan program?

You can access a wealth of information about the USDA loan program on the USDA Rural Development website. You can also contact a USDA-approved lender or a local housing counseling agency for guidance.

Tips for Navigating the USDA Loan Process in North Carolina

- Consult the USDA Loan Map: Start by utilizing the USDA Loan Map to determine your eligibility and identify eligible properties.

- Seek Pre-Approval: Obtain pre-approval from a USDA-approved lender before starting your property search.

- Work with a Real Estate Agent: A knowledgeable real estate agent can guide you through the process and identify eligible properties.

- Shop Around for Rates: Compare interest rates and loan terms from multiple USDA-approved lenders to find the best deal.

- Review the Loan Documents Carefully: Thoroughly review all loan documents before signing to ensure you understand the terms and conditions.

- Seek Professional Advice: Consult with a financial advisor or housing counselor for personalized guidance and support.

Conclusion

The USDA Loan Map is a valuable resource for individuals seeking to purchase a home in North Carolina. By understanding the program’s eligibility criteria and leveraging the map’s information, potential homebuyers can navigate the path to homeownership with greater clarity and confidence. The USDA loan program offers a unique opportunity for eligible borrowers to achieve their homeownership dreams, providing access to affordable and sustainable housing solutions in rural and eligible suburban areas.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Path to Homeownership in North Carolina: Understanding the USDA Loan Map. We appreciate your attention to our article. See you in our next article!